The real estate market is constantly shifting, and as an investor, staying ahead of these changes is crucial. At Premier Business Press, we believe that to succeed in real estate, investors must be able to read the signals that the market is sending. These signals help you make smarter decisions, whether you’re just starting or looking to grow your portfolio.

This guide will walk you through smart real estate investment strategies, offering clear, actionable steps that make sense in today’s market. You’ll learn how to spot key trends, adapt to market changes, and set yourself up for long-term success.

Recognising Real Estate Market Cycles And Key Indicators

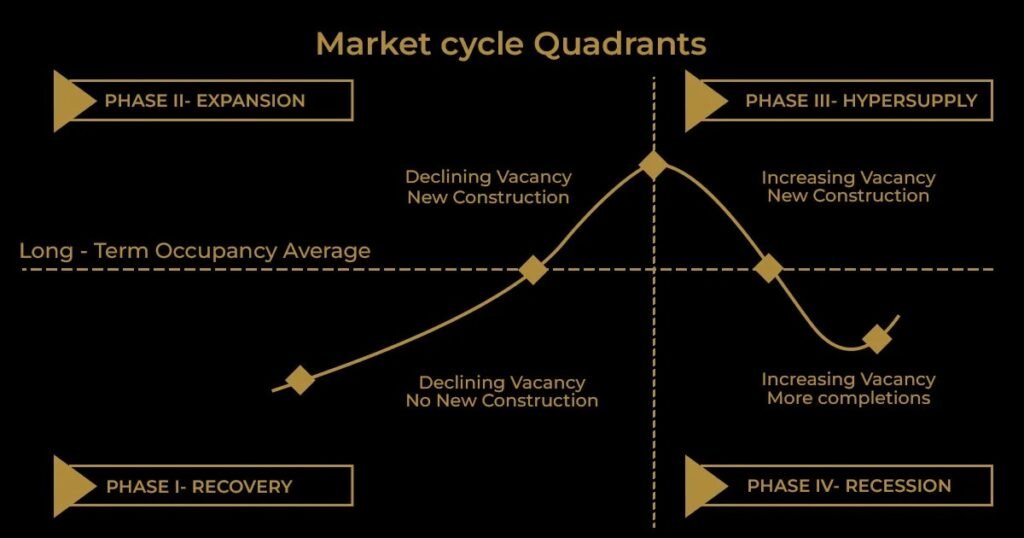

The real estate market isn’t static. It moves through phases. From expansion to recession, understanding these phases is essential. But simply knowing that the market is in a “growth” or “slowdown” phase isn’t enough.

To truly decode the market, you need to look beyond just these broad phases and identify key indicators that can give you an edge. For example, tracking local job growth or shifts in rental demand can offer a more immediate and precise view of market conditions. Government investment, such as new infrastructure projects, often signals a potential rise in property investment analysis.

Here’s how you can identify and use these indicators effectively:

- Job Growth:

Areas experiencing strong job growth are often entering an expansion phase. This can lead to increased demand for housing, both for rent and sale. If you track this data early, you can make smart property acquisitions in growing markets before they become saturated. - Rental Demand:

Shifting rental demand is another key signal. High demand for rental properties often signals rising housing prices, making it an ideal time for investment. Keep an eye on vacancy rates and rental price increases in specific neighborhoods. - Government Investment:

New infrastructure projects or government funding often signal future market growth. For instance, the construction of new highways, schools, or public transit can make an area more desirable and increase property values. Monitoring these developments gives you insight into emerging opportunities. - Supply and Demand Balance:

Look for shifts in supply vs demand. An oversupply of properties in a specific area can lead to hyper-supply, which often precedes a recession phase. Conversely, a lack of housing in high-demand areas will likely trigger an expansion phase. - Market Sentiment:

Stay updated on how other investors feel about a region or sector. News trends, real estate reports, and social media chatter can indicate whether investors are leaning toward buying, selling, or waiting for a better time.

Start Mastering Real Estate Investment Strategies Today

Discover actionable tips and proven strategies to decode the market..

Get Started NowUsing Data To Guide Your Investment Decisions

In today’s fast-paced market, relying on guesswork is no longer enough. Data-driven investment decisions are essential. With the correct data, you can evaluate potential investments more effectively, ensuring that you’re not just hoping for a good return but actually planning for it.

When you analyse real estate data analysis, pay attention to key metrics like:

- Rental yield and price-to-income ratios to assess profitability.

- Vacancy rates can help you gauge how well a location is performing.

- Market demand: Is the area growing? Are more people moving in?

By using the correct data, you can confidently make decisions about which properties to invest in, based on the market’s real-time performance. At Premier Business Press, we help you navigate this data, making it easier to find real estate investment opportunities that align with your goals.

Smart Property Acquisitions

The key to a successful portfolio isn’t just about buying as many properties as possible. It’s about knowing when and where to invest. Property acquisition strategies are central to growing your portfolio while maintaining healthy returns.

Here are a few things to focus on:

- Location matters: Areas with developing infrastructure or strong job growth tend to provide the best long-term returns.

- Value-add properties: Look for properties that may need some improvements but have great potential once renovated or repositioned.

- Timing: Acquiring properties in the early stages of growth can provide significant returns, but knowing when to buy and when to wait is crucial.

A thoughtful approach to property portfolio management helps you stay aligned with your long-term investment goals. By strategically acquiring properties, you can ensure sustained portfolio growth and reduce the risk of market fluctuations.

Have Sales Techniques for Faster Closures

Unlock expert advice on closing deals quickly and efficiently.

Learn How to Close FasterManaging Risk in a Shifting Market

Every investment comes with risk. In real estate, understanding risk management is essential for maintaining a profitable portfolio, especially in a market that is constantly changing. Diversification is one of the most effective ways to manage risk. Spread your investments across different property types and locations to protect against downturns in any one market.

- Maintain a cash reserve for unexpected expenses or vacancies.

- Monitor market cycles: When interest rates rise or economic conditions change, adjust your strategy to maintain profitability.

Risk management isn’t just about avoiding losses. It’s about positioning your portfolio to thrive, no matter the market conditions.

Knowing When To Exit Or Hold

Real estate investing is about more than just buying and holding. It’s also about knowing when to sell or hold a property. An effective exit strategy can help you maximise returns and avoid unnecessary losses.

Consider these tips:

- Sell at market peaks: When the market is at its highest point, it’s a great time to sell and realise your gains.

- Hold for steady income: In a recession or market slowdown, holding onto properties that provide consistent rental income may be a better option.

- Refinance: If your property has appreciated in value, refinancing allows you to pull out equity and reinvest in new opportunities.

The key is to stay flexible and adapt your exit strategy to current market conditions. Check out our previous blog, “How to Build a Real Estate Empire: Strategies from Premier Business Press.”

Take Control of Your Real Estate Future

Learn how to integrate investment tactics and effective sales strategies to grow your real estate empire.

Start Building Your EmpireScaling Your Portfolio

Scaling your real estate business doesn’t happen overnight, but with the right plan, it’s entirely possible. As your portfolio grows, it’s essential to develop systems that can support the increased volume of properties.

To scale effectively:

- Leverage your equity: Use the equity from your properties to fund additional acquisitions.

- Focus on automation: Streamline processes with property management software and by hiring the right teams.

- Reinvest profits: Don’t just cash out. Use profits to purchase more properties and expand your empire.

According to the Bureau of Labor Statistics, there were 229,840 real estate managers employed in the U.S. as of May 2023, highlighting the scale of the real estate sector. Scaling a real estate portfolio management requires careful planning and systems that allow you to manage more assets without losing control.

Final Thoughts

Decoding the market and making informed decisions is the foundation of successful real estate investing. By understanding market shifts indicators, using data to guide your choices, and knowing when to act, you can build a real estate empire that stands the test of time.

With smart real estate strategies and data-driven insights, you’ll be prepared to not only manage risk but thrive in any market phase. The key is consistency, strategic planning, and taking actionable steps at the right time.

To learn more about building a real estate empire and access helpful resources, check out our Complete Business Library or visit Premier Business Press.

FAQs

1. What are the most effective real estate investment strategies for today’s market?

To succeed in today’s dynamic market, investors should focus on data-driven decision-making, leveraging market research, and property portfolio growth. Rental properties in areas with rising demand, as well as value-add strategies in underdeveloped markets, are proven methods for creating long-term wealth in real estate.

2. How do I decode real estate market cycles to make smarter investment decisions?

Understanding the different phases of a market. Recovery, expansion, hyper-supply, and recession are critical. Investors can use key indicators such as market shifts, economic trends, and property demand/supply fluctuations to time acquisitions and exits, ensuring the highest possible returns in each cycle.

3. What does successful property portfolio management look like for long-term success?

Effective portfolio management involves monitoring key metrics such as real estate wealth building, cash flow, and property appreciation. Investors should focus on scaling property business with a mix of stable rental income and appreciation, while diversifying across property types and locations to mitigate risk.