When it comes to wealth building, most people focus on strategies like investing, budgeting, or finding side gigs. But there’s another crucial element that often gets overlooked: financial behavioral psychology. How you think about money, your emotional reactions, subconscious biases, and mental patterns can profoundly impact your financial decisions. In this article, we’ll dive into the psychology of money decision‑making, explore common cognitive biases in financial behaviour, and uncover how understanding your money brain can unlock lasting wealth.

Why Financial Behavioral Psychology is Essential for Wealth Creation

Understanding financial behavioral psychology helps you identify why you make confident financial decisions, even when they may not align with your long-term goals. This field focuses on how our emotions, beliefs, and biases shape our economic choices. For example, emotional factors in personal finance, like fear or greed, can drive impulsive buying or investing decisions. By recognizing these emotions, you can better manage your responses and make more informed, rational choices.

This deeper understanding allows you to avoid the common mistakes many investors make, driven by subconscious biases. This is where behavioural finance and investment decisions come into play, showing that our choices are often influenced by psychological factors rather than logic.

Ready to Break Free from Financial Self-Sabotage?

At Premier Business Press, we help you reprogram your financial subconscious and build lasting wealth with actionable strategies.

Book a Free Consultation Now!The Key Cognitive Biases That Affect Financial Decision-Making

To make better financial decisions, it’s essential to understand the cognitive biases that shape your behavior. Here are some of the most common biases:

- Loss Aversion: This bias makes people fear losing money more than they enjoy gaining it. As a result, many people avoid taking necessary risks, even if they could lead to higher returns. It’s a key factor in poor investment decisions.

- Overconfidence Bias: Many investors believe they know more than they do, leading to risky, uncalculated decisions. This is where investor behaviour and behavioural psychology intersect misplaced confidence often leads to significant financial setbacks.

- Herd Mentality: When people follow the crowd, especially in investing, they tend to make decisions based on others’ actions rather than their own research. This can lead to poor choices and missed opportunities.

- Anchoring: Investors often fixate on a past price point or value, which can prevent them from making objective, future-focused decisions.

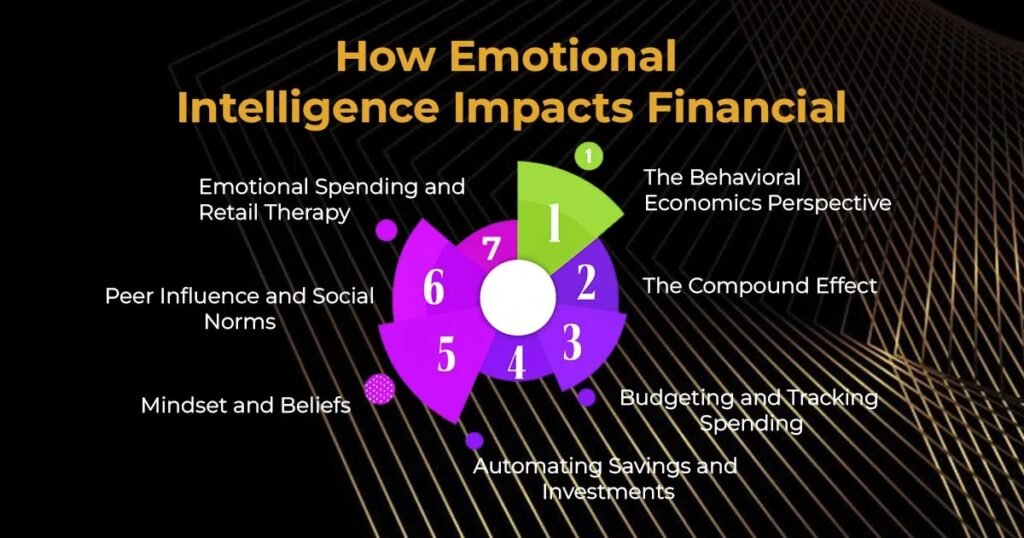

How Emotional Intelligence Impacts Financial

Emotional intelligence and money are closely linked. It’s not just about managing money but also about managing your emotions when making financial decisions. People with high emotional intelligence (EQ) are better able to control impulsive decisions, resist temptations, and stay calm during economic stress.

For example, fear can prevent you from investing or taking on any financial risk, while greed can push you into speculative investments. By building emotional awareness and using techniques like mindfulness or stress management, you can avoid letting emotions dictate your financial outcomes.

Struggling with a Scarcity Mindset About Money?

We offer guidance on how to break the scarcity mentality and develop healthy financial habits.

Start Your Transformation Today!Why Do People Make Bad Financial Decisions?

Understanding why people make bad financial decisions is key to improving your own financial behavior. It often comes down to cognitive biases and emotional triggers that cloud judgment. For instance, cognitive biases in investing, such as overconfidence or loss aversion, can lead individuals to make risky or overly cautious financial decisions.

Additionally, emotional factors in personal finance, such as anxiety or the fear of missing out (FOMO), can lead people to make impulsive decisions that don’t align with their long-term goals. To avoid these traps, it’s essential to recognize these emotional drivers and take steps to mitigate their effects.

Developing Financial Discipline: How to Create Better Financial Habits

The key to overcoming these psychological hurdles is developing financial discipline. Building disciplined financial habits isn’t just about controlling your spending; it’s about consistently aligning your actions with your financial goals. Here are a few steps to help you develop better discipline:

- Set clear, measurable financial goals: Whether it’s saving for retirement or paying off debt, having specific goals helps you stay focused and reduces the temptation to make emotional decisions.

- Create and stick to a budget: By knowing exactly where your money is going each month, you’re less likely to make impulsive, unnecessary purchases.

- Automate your savings: Set up automatic transfers to your savings or investment accounts so you’re consistently building wealth without the temptation to dip into your funds.

The Role of Habits in Building Wealth

Your financial success is not just determined by big decisions but by the small habits you practice every day. These habits shape your long-term wealth trajectory. Some critical financial habits include:

- Tracking your expenses: This allows you to spot areas where you can cut back and save more.

- Investing consistently: Even small, regular contributions can compound over time.

- Reviewing your financial situation regularly: Regular check-ins help you adjust your strategies and stay on track.

Take Control of Your Financial Future Today

Gain insights into emotional intelligence and money, and learn how to make clear, confident decisions that build wealth.

Book a Free Strategy Session!How to Manage and Overcome Financial Biases

To truly succeed in wealth building, you must manage and overcome the biases that affect your decisions. Start by tracking your emotions and biases. Keep a journal of your financial decisions and reflect on whether emotions influenced them. Next, practice a mindset for wealth creation or other techniques to stay calm and clear-headed when making economic choices. This will help you make decisions based on logic rather than emotion.

Conclusion

Incorporating the principles of financial behavioral psychology into your daily life can dramatically improve your financial decisions. By understanding the cognitive biases in financial behaviour, managing emotional intelligence and money, and developing financial discipline, you can create a solid foundation for long-term wealth.

If you’re ready to take your financial knowledge to the next level, dive deeper into wealth-building strategies and habits by exploring Wealth Psychology Secrets. To learn more about how we help individuals like you build financial success, check out our About Us page.

FAQs

- Why do people make bad financial decisions?

Poor financial decisions often stem from emotional triggers like fear or greed. Cognitive biases in investing, such as loss aversion, also play a significant role in causing irrational choices, especially when emotions override logical financial strategies.

- What are common cognitive biases in investing, and how do they affect investors?

Cognitive biases in investing include overconfidence, herd mentality, and anchoring bias. These mental shortcuts often cause investors to make rushed or poorly thought-out decisions, leading to market losses or missed opportunities.

- How do emotional intelligence and money impact financial decision-making?

Emotional intelligence and money go hand in hand. High emotional intelligence helps you manage stress and remain calm during financial decision-making, reducing the likelihood of impulsive, financially damaging choices.

- What steps can I take to develop financial discipline?

Developing financial discipline involves setting clear goals, tracking your spending, automating savings, and staying consistent with your financial decisions. This discipline is key to building wealth over time and resisting impulsive purchases.

- How do cognitive biases in investing contribute to poor financial decisions?

Cognitive biases in investing, such as confirmation bias, recency bias, and loss aversio,n often lead investors to ignore data or make decisions based on emotion rather than logic. This can result in losing opportunities or taking on unnecessary risk.